The global pandemic has forever altered the logistics real estate landscape: supply chain decisions have become more holistic, more data-driven and more urgent than ever. Underlying this shift are the same forces -- urbanization, digitalization and demographics -- that have changed the way we live, work and shop.

This report aims to separate the transitory nature of human and company behavior during the pandemic from the real lasting forces that will continue to drive the supply chains of the future. For example, Prologis Research expects a spike in spending on experiences, such as travel and entertainment, and in-store shopping in mid to late 2021 due to the release of pent-up demand created by COVID-19 restrictions. Sustainable forces shaping logistics real estate demand include:

- The long-term structural growth rate of logistics real estate has risen. Consumption-oriented uses have grown as a share of logistics demand, while production- and trade-oriented uses have decreased.

- Technology and demographics are transforming retail. Consumer expectations have increased in a permanent way. Prologis Research forecasts that global e-commerce penetration will rise by ~150 bps/year over the next five years. Physical retail will increasingly require rapid replenishment operations to compete.

- Logistics best practices are going global. The resilience of the supply chain is being tested as companies expand globally, in turn driving the need for modern stock and decentralized networks. Coupled with a rising consumer class, this worldwide upgrade should generate the need for three to four billion square feet or more of modern logistics stock over the next cycle.1

- Location matters more than ever for logistics real estate customers. Supply chains are a key source of competitive advantage and will continue to drive financial performance.

- The price elasticity of demand has decreased. Network planning decisions can yield revenue generation and cost control benefits that substantially outweigh real estate expenses, which represent just 5% of overall supply chain costs.2

While the correlation with economic variables has changed, parts of the business will not change. Many small and mid-sized customers depend on local economic and investment trends. For those customers who are responding more directly to evolving retail and supply chain strategies, the future of the supply chain and its concurrent effect on retail will determine demand and shape customer profiles for many years.

1. The long-term structural growth rate of logistics real estate has risen.

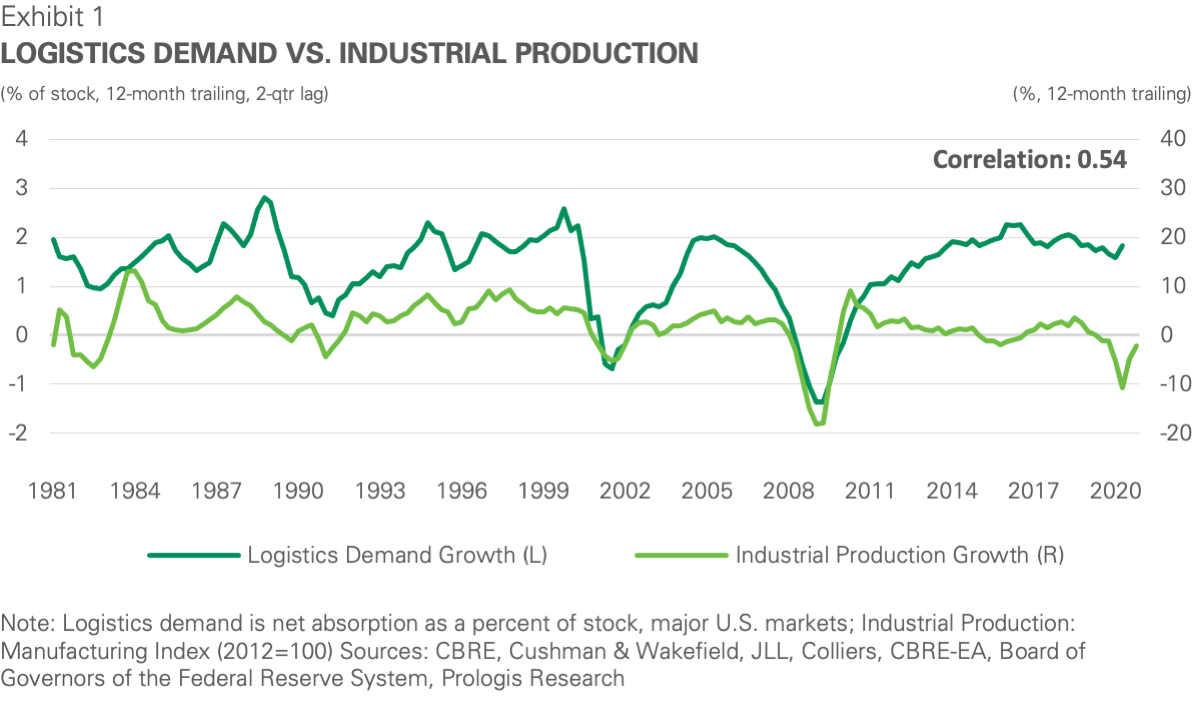

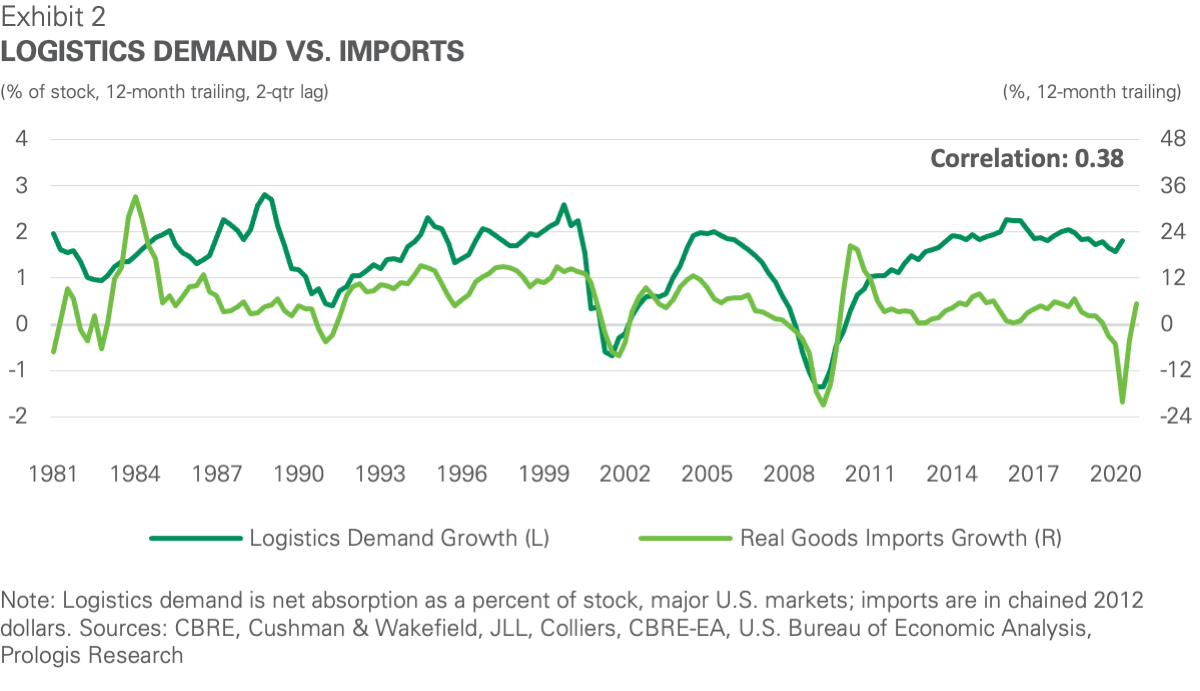

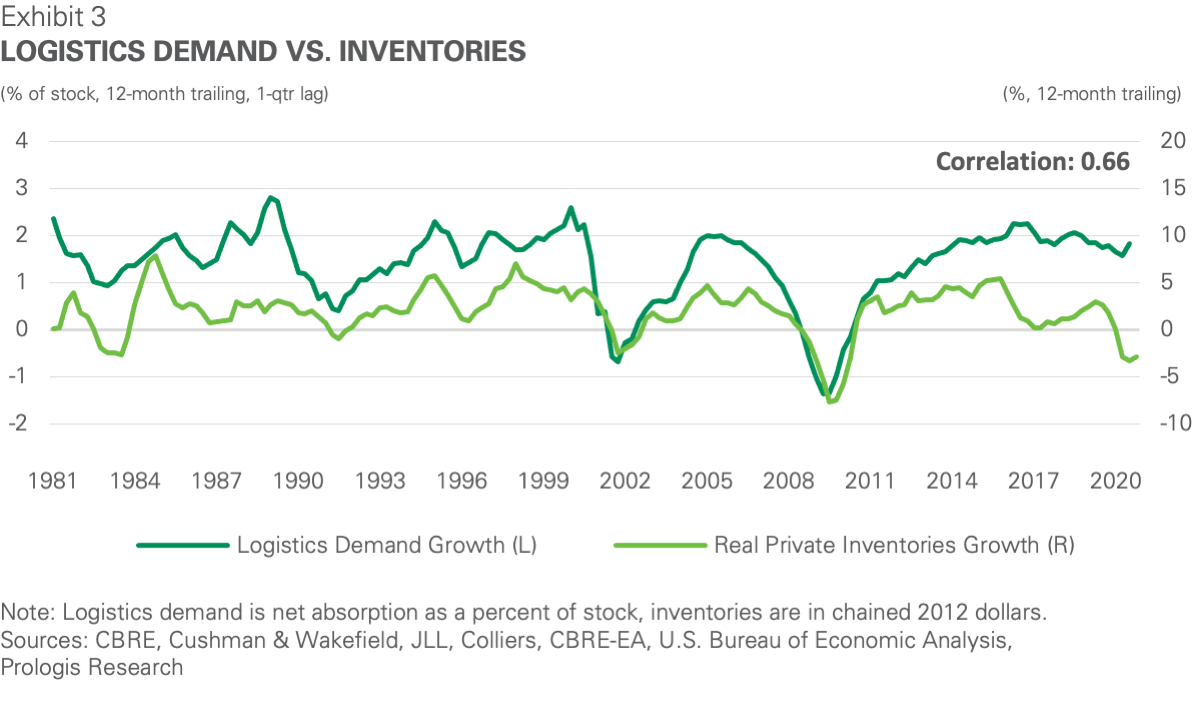

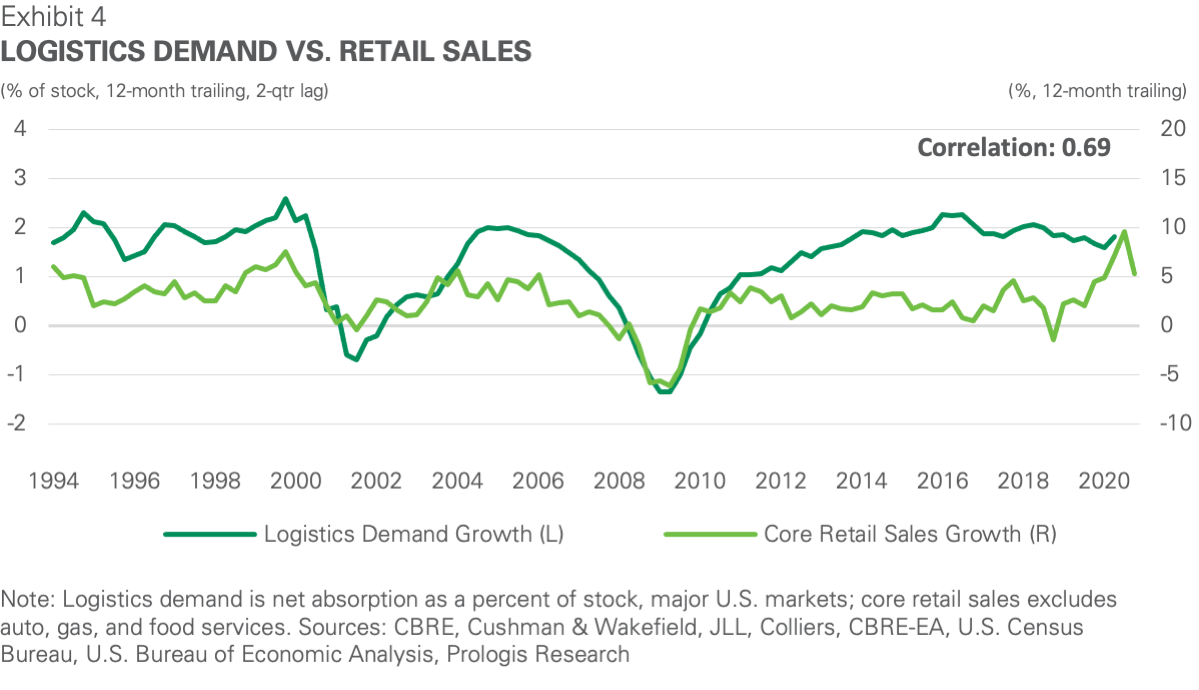

Economic growth now requires more logistics real estate than in the past. Consumption has advanced as the primary driver of demand on the global level. Retail sales have a higher correlation with logistics demand growth than do drivers of the past – namely, manufacturing and trade (see Exhibits 1-4). In addition, changes in how we consume are further amplifying this shift, because e-commerce is more space intensive.

2. Technology and demographics are transforming retail.

Demographic trends, the rapid pace of technological change and COVID-19 have transformed how we live and our notion of what is possible, driving an evolution in retail and boosting logistics demand. Millennials – digital natives who now comprise 23% of the global population3 – have entered higher income brackets and are a primary target for retailers. At the same time, dual-income households continue to rise.4 The internet as a platform for commerce continues to expand around the world; over the past decade, about 2 billion people gained internet access.5 Consumer expectations have increased in a permanent way, favoring convenience, choice, reliability and immediacy. Naturally, the combination of new digital options and a desire for convenience have propelled the adoption of e-commerce. E-commerce as a proportion of retail goods sold globally grew to nearly 20% in 2020 from about 4% in 2011.6

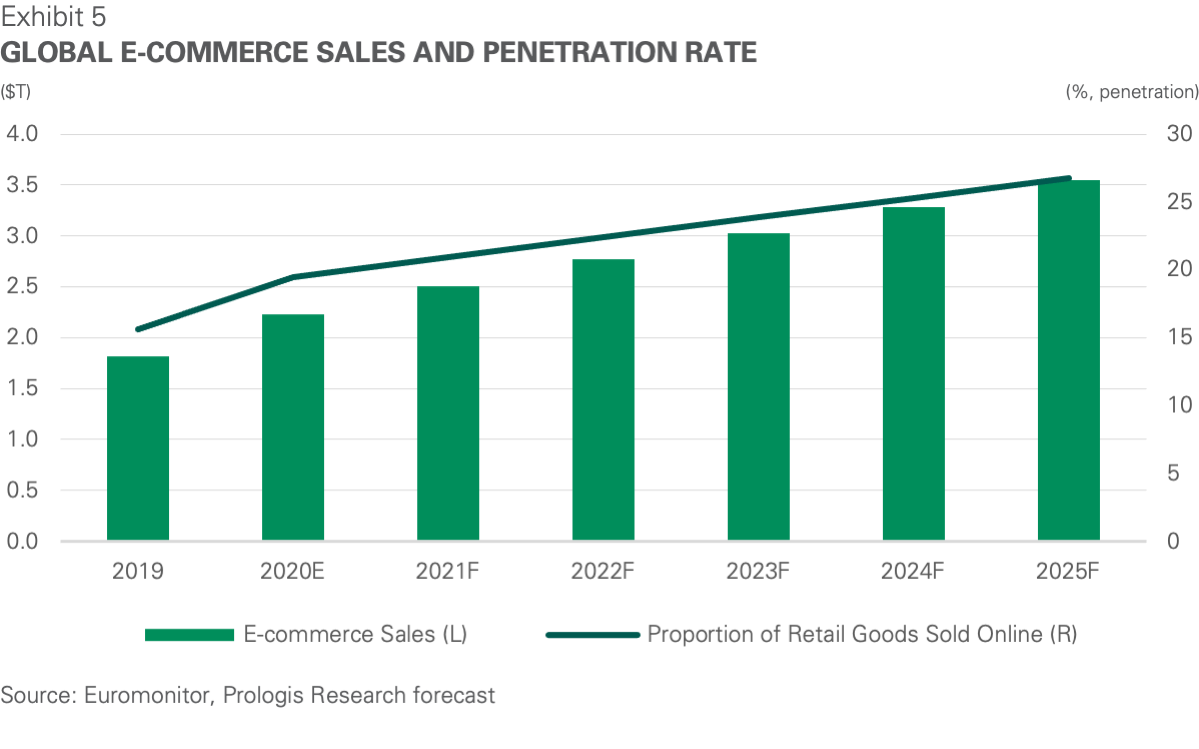

COVID-19 and stay-at-home orders pulled e-commerce adoption forward, prompting supply chain investments that will yield future growth. Globally, e-commerce penetration increased at an outsized rate of 390 basis points in 2020 due to the pandemic, equal to roughly five years of adoption (see Exhibit 5). Senior populations and other late adopters, as well as retailers, overcame barriers to online shopping out of necessity. Given pandemic-related constraints on services and brick-and-mortar spending, it is possible that e-commerce growth will temporarily slow once vaccines are distributed broadly and consumers relish the novelty of in-person shopping, travel and entertainment. However, before COVID-19, a structural shift in retail was already in play.

Prologis Research expects that e-commerce penetration will continue to rise due to the following reasons:

- Consumers habits are “sticky” once barriers to adoption are overcome.

- Innovation and supply chain investments made during or in the wake of the pandemic should increase competitiveness of online options. This is especially true for segments with low e-commerce penetration prior to the pandemic such as grocery and home improvement.

- The challenges faced by brick-and-mortar retailers in the near term should mitigate future competition for consumers. More than 15,000 U.S. retail outlets were closed between 2017 and 2020 on net (see Exhibit 6).7

Still, in order to compete, brick-and-mortar retail will need to meet the same demands for convenience and reliability as offered by online shopping. Options to buy online and pick-up in store could drive traffic and sales post-pandemic, but would put increased pressure on store inventories, necessitating a rapid replenishment operation close to stores to keep shelves stocked.

Online order fulfillment requires more than 3 times the logistics space of brick-and-mortar8 because:

- All inventory is stored within a warehouse.

- Digital storefronts offer greater product variety.

- Higher volatility in sales patterns necessitates deeper inventory levels.

- Parcel shipping requires more space than shipping pallets.

- Many e-fulfillment operations include value-add activities such as assembly and reverse logistics.

Taken together, this intensity of use generates substantial incremental demand as a greater proportion of retail goods are sold online. The forecasted share shift alone (holding sales constant) should drive the need for an incremental 125 million square feet (MSF) of logistics space or more per year through 2025 in the U.S. and Europe alone.9

3. Logistics best practices have gone global.

Leveraging data and technology in retailing and supply chain management creates a competitive advantage that can help companies more efficiently scale and globalize operations. Rising consumer classes across the world have increased the growth opportunity for companies able to successfully establish their operations in new locations. As businesses cross borders, they bring logistics real estate requirements and supply chain best practices, driving the need for modern logistics facilities, including those that serve Last Touch® and High Throughput Distribution® (HTD®) operations. Large companies, which tend to have more robust financial and technological resources, have grown at a faster rate than medium- and small-sized companies, which often do not have the same ability to deploy best practices and take advantage of growth in other geographies (see Exhibit 7). On average, the adoption rate of modern logistics is about 35 square feet per consumer household today (see Exhibit 8). A rise in that ratio to 40 to 50 square feet by 2030 would yield the need for three to four billion square feet in the world’s largest logistics markets.10

Supply chain disruptions have punctuated the need for resilience. For decades, supply chains have been moving to globalize, take advantage of cost differentials and streamline to a just-in-time model in order to reduce inventory carry costs (see Exhibit 9). At the same time, disruptions have extended beyond natural disasters, congestion and labor disputes to include major trade renegotiations and a global pandemic. The supply chain risks that have been exposed include:

- Minimal on-hand inventory, which leads to stock-outs when consumer demand shifts quickly.

- Single source of origin and low supply chain visibility, which together limit the ability to source goods when disruptions hit.

- Long lead times and trade bottlenecks, which prevent goods from getting to end consumers as quickly as they are needed.

Higher inventories add resilience and amplify the need for logistics real estate. The shift from just-in-time to just-in-case supply chains could drive inventories up by more than 5-10%. In the U.S., Prologis Research estimates this shift could create 57-114 MSF of additional logistics demand per year over the next five years without accounting for a rise in sales.11

Maintaining production bases close to destination markets shortens production lead times for businesses and provides protection against lost revenue, lost customers and higher costs. However, wages are cost-prohibitive for large-scale reshoring to the United States and much of Europe. Multinational corporations have pursued near-shoring instead, establishing production facilities in markets adjacent to end consumers such as Mexico and Central and Eastern Europe. Still, the bulk of consumer goods production and upstream supply chain operations will likely remain in Asia, home to half of the world’s middle class, with attractive labor pools and industrial infrastructure, particularly in China.12 This strategy has a dual benefit as the rise of China’s consumer class has led to a transformation of its supply chains – originally configured for exports, today they are being designed to serve domestic consumption.

4. Price elasticity of rents has decreased because location selection matters more than ever before.

Customers are now more willing to pay higher rents. This is in part because rent does not represent a large share of supply chain costs (only about 5%).13 More importantly, supply chains are increasingly viewed holistically and used as a competitive advantage. For most users, the revenue generation benefits from being able to meet consumer demands for product availability, choice and delivery speed greatly outweigh the additional real estate costs. Locating closer to consumers reduces transportation costs, which account for about 50% of supply chain costs.14 A recent study by MIT on carbon emissions revealed that adding an urban fulfillment center can cut transportation emissions (and therefore costs) by half compared to out-of-town distribution.15 Technology has lessened price sensitivity because it has enabled customers to increase productivity, particularly in urban locations with lower vacancy that have higher rents and higher labor costs compared to non-urban locations.

Urbanization and rising consumer expectations will continue to increase the benefits of an urban location. The world’s urban population doubled over the past 30 years and is forecast to double again during the next 30 years16 with major implications on consumption, transportation and land use. Whether to the shelves or doorstep, consumers have been conditioned to expect more. Densifying consumption centers will produce larger revenue opportunities while rising consumer expectations and congestion will produce larger challenges for global supply chains. Logistics real estate in locations close to end consumers offers the ability to reach homes and retail outlets quickly and realize transportation cost savings – key sources of competitive advantage today and in the future.

In Summary

Demographic, economic and technological mega-trends will continue to drive the future of retail and supply chain planning, raising the structural long-term growth rate of logistics real estate demand through the next decade and beyond. Prologis Research will continue to explore the evolution of the supply chain and examine how supply will respond to future structural changes in an upcoming paper.

Endnotes

1. Oxford Economics, Prologis Research

2. Deloitte, AT Kearney, IMS Worldwide, public company filings, Prologis Research

3. United Nations

4. UNESCO Institute for Statistics (uis.unesco.org); Data as of September 2020

5. International Telecommunication Union, World Telecommunication/ICT Development Report and database, and World Bank estimates

6. Euromonitor, Prologis Research

7. Coresight Research as of March 2021, net= store openings – store closings

8. https://www.prologis.com/logistics-industry-research/covid-19-special-report-6-accelerated-retail-evolution-could-bolster

9. https://www.prologis.com/logistics-industry-research/covid-19-special-report-5-supply-chain-shifts-poised-generate

10. Consumer household forecast from Oxford Economics as of March 2021; major markets include U.S., Europe, China, Japan, Mexico and Brazil

11. https://www.prologis.com/logistics-industry-research/covid-19-special-report-5-supply-chain-shifts-poised-generate

12. World Economic Forum

13. Deloitte, AT Kearney, IMS Worldwide, public company filings, Prologis Research

14. Deloitte, AT Kearney, IMS Worldwide, public company filings, Prologis Research

15. https://www.prologis.com/logistics-industry-research/logistics-real-estate-and-e-commerce-lower-carbon-footprint-retail

16. United Nations Population Division. World Urbanization Prospects: 2018 Revision.

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 984 million square feet (91 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.